How to Accurately Determine the Value of Your Property

Key Takeaways

- Understanding your property’s value is critical for making informed financial decisions such as selling, refinancing, or tax planning.

- Combining online tools, professional advice, and public records provides a comprehensive property valuation.

- Regularly tracking market trends and consulting professionals ensures your valuation remains relevant and current.

Table of Contents

- Understand Market Value

- Utilize Online Valuation Tools

- Conduct a Comparative Market Analysis (CMA)

- Hire a Professional Appraiser

- Review Public Records

- Consider the Cost Approach

- Stay Informed About Market Trends

- Consult Real Estate Professionals

Understanding the current value of your home is fundamental, whether you’re selling, refinancing, or planning for the future. Additionally, the condition of your property plays a major role in its overall valuation. Homes that have undergone professional property restoration in Ridgefield—such as repairs after water damage, fire incidents, or structural wear—tend to appraise higher and attract stronger buyer interest. Addressing restoration issues proactively not only protects your investment but also ensures that appraisers, buyers, and online valuation tools accurately reflect your home’s true market value.

Ultimately, knowing your pricing accuracy puts you in control, helps you avoid leaving money on the table, and ensures you’re prepared for negotiations. For those serious about selling in highly competitive markets, connecting with a knowledgeable Georgetown, DC real estate agent can be a powerful advantage from the start.

The process of coming to an accurate appraisal is multifaceted. It involves not only online research but also leveraging the advice of professionals and analyzing the unique characteristics of the local market. Without a thorough approach, you risk mispricing your property, potentially causing a longer market time or missed opportunities.

While quick estimations are easier than ever, the limitations of automated tools and the nuances of individual properties mean it pays to dig deeper. Do-it-yourself methods, professional insights, and continuous market monitoring all play roles in achieving a true picture of value.

1. Understand Market Value

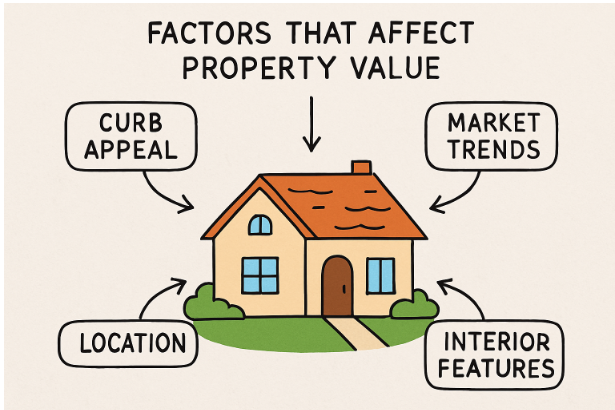

Market value is essentially the price a willing buyer would pay a willing seller, free from unusual pressure. This figure changes with market dynamics and is influenced by:

- External Characteristics: First impressions matter—features such as curb appeal, lot size, and architecture play a significant role.

- Internal Characteristics: Updates, square footage, and overall condition are key factors.

- Supply and Demand: More buyers than homes can drive prices up, while an abundance of listings may prompt sellers to lower their prices.

- Location: Proximity to award-winning schools, walkability, and neighborhood amenities can all enhance value.

State and local agencies, including the New York State Department of Taxation and Finance, provide market value estimates and sales data for additional context and reference.

Utilize Online Valuation Tools

Automated Valuation Models (AVMs) like those found on real estate listing sites gather historical sales data, tax records, and current market trends to provide a quick estimate. While useful as a starting point, they can’t factor in upgrades, property quirks, or local shifts that impact your home’s unique value. Treat online estimates as a guide, not a verdict.

Conduct a Comparative Market Analysis (CMA)

One of the most reliable approaches is a Comparative Market Analysis. By examining the sale prices of homes that closely match yours in size, age, and location, you’ll understand where your property fits within your market. Key areas to compare include:

- Lot dimensions and overall area

- Finished living space (square footage)

- Number of bedrooms and bathrooms

- Condition and updates

- Neighborhood attributes

Skilled agents use their experience and access to real-time MLS data to perform CMAs, which usually results in a more nuanced and accurate valuation compared to generic automated models.

Hire a Professional Appraiser

For the gold standard in property valuation, a certified appraiser analyzes all important factors—from a detailed inspection to neighborhood market shifts—before delivering an unbiased opinion of value. This is often required for loan approvals or legal matters. According to Bankrate, the average cost is around $350, but the accuracy and peace of mind can be invaluable, especially for unique or high-value properties.

Review Public Records

Public records held by your local assessor’s office include tax assessments and previous sale prices, which can provide a rough benchmark for value. While tax valuations don’t always reflect current market prices, reviewing this data alongside recent sale records in your immediate area helps establish a well-informed price range.

Consider the Cost Approach

The cost approach calculates value by estimating the expense to rebuild your property with similar materials and functionality, minus depreciation. It is especially relevant for newer homes, where construction costs are more consistent. Older homes, however, may require expert analysis due to complex depreciation variables and custom attributes.

Stay Informed About Market Trends

Local and national economic shifts, interest rate fluctuations, and developments in your neighborhood continually impact property values. Regularly monitor trustworthy sources to stay informed about trends that could impact the value of your current and future homes.

Consult Real Estate Professionals

Partnering with a skilled real estate agent or broker provides you with a pulse on local activity, strategic advice for maximizing value, and hands-on help in pricing and negotiation. These professionals can offer customized recommendations, guidance on home improvements, and reassurance throughout the selling or buying process.

By combining these strategies—using online research as a baseline, partnering with real estate experts, conducting robust comparative analyses, and staying abreast of market conditions—you’ll gain a clear and accurate understanding of your property’s value and the confidence to make smart financial moves.

Samar

Punsuniverse — a realm crafted by me, Samar! You will find everything here that is related to puns, weather its food, animals, names or something elsse.